Making sense of connected car data

In this article: The vehicles we drive are providing huge amounts of information, bringing data management challenges to the fore. LexisNexis Risk Solutions’ Paul Stacey looks at the challenges and benefits of this new world

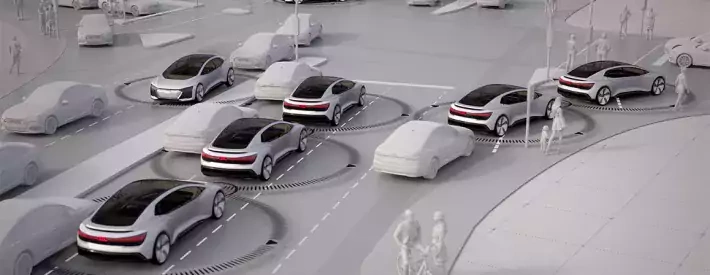

Connectivity from cars is moving at a rapid pace and in many cases driven by Ecall, the advance of ADAS capabilities and the UK’s first level three semi-autonomous car has hit the roads. At the heart of these developments and the future development of semi- and fully automated vehicles is data – masses of it.

Consultation paper

In June, the Law Commission published the response to its consultation, Automated Vehicles: A joint preliminary consultation paper. It recommended that beyond the initial safety of the vehicle itself, a safety assurance scheme should be established that deals with driver training, software updates, continuing roadworthiness and the management of data.

The recommendations have underlined again the pressure to become data experts.

Connected car data is taking the sector into new regulatory environments where they must deal with consumer consents regarding data use to deliver value-added services such as insurance. The process might be painful, but this work is crucial to create the foundation for the mobility services of tomorrow.

Progressive companies are already using connected car data to evolve car design, enhance ADAS systems and engage consumers with driving behaviour information, collision detection and other services that connectivity enables. Data will help carmakers know more about their customers to better serve them throughout the lifecycle of vehicle ownership and through life events that change a consumer’s needs.

Given that insurance is the highest cost of vehicle ownership after the vehicle itself, and that insurance will help determine the ride-sharing services, many manufacturers are looking to offer customers understanding how data about the vehicle and the way it’s driven could be used for insurance pricing and risk reduction is a key focus for the sector.

The good news is that there is already evidence for the risk mitigation and pricing benefits of real-time data in telematics insurance or Usage Based Insurance (UBI) which can now help shape the way insurance and other customer services are delivered from increasingly autonomous vehicles.

At the same time, other types of vehicle data are now being explored, such as ADAS data to help motor manufacturers understand the direct impact of safety features on insurance claims.

The key challenge is that as connected car volumes continue to grow, there will be more data from many different aftermarket devices, many types of vehicles from many car manufacturers and many ways to describe vehicle safety features. This will put demands on mobility providers to find a way to share their data in a meaningful way and in a fully compliant manner to support consumer choice. The principles in the data ethics framework and the General Data Protection Regulation provide a foundation for this.

A neutral sever taking data from both the insurance and car manufacturing sectors may also provide a solution. A central hub of data would help ensure consistent scoring of driving data and enable data portability, all with the consumers’ interest front and centre.

Data management will provide a cornerstone for the safety of self-driving vehicles. Car manufacturers can put themselves in a strong position to deliver on the safety assurance scheme through the connected car and vehicle build data here today.