Vacancy Tracker - December 2025

Each month, we analyse UK job vacancy data from the Office for National Statistics (ONS) to to track recruitment pressure in the Motor Trades sector.

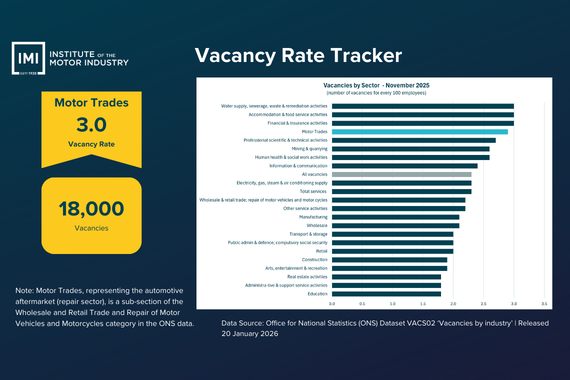

The latest ONS figures, covering October to December 2025, estimate around 18,000 open roles across the Motor Trades. This follows a short-term rise in mid-2025 and suggests that hiring demand has levelled off rather than continuing to climb.

Automotive vacancies: December 2025 at a glance

- Vacancy rate: 3.0%

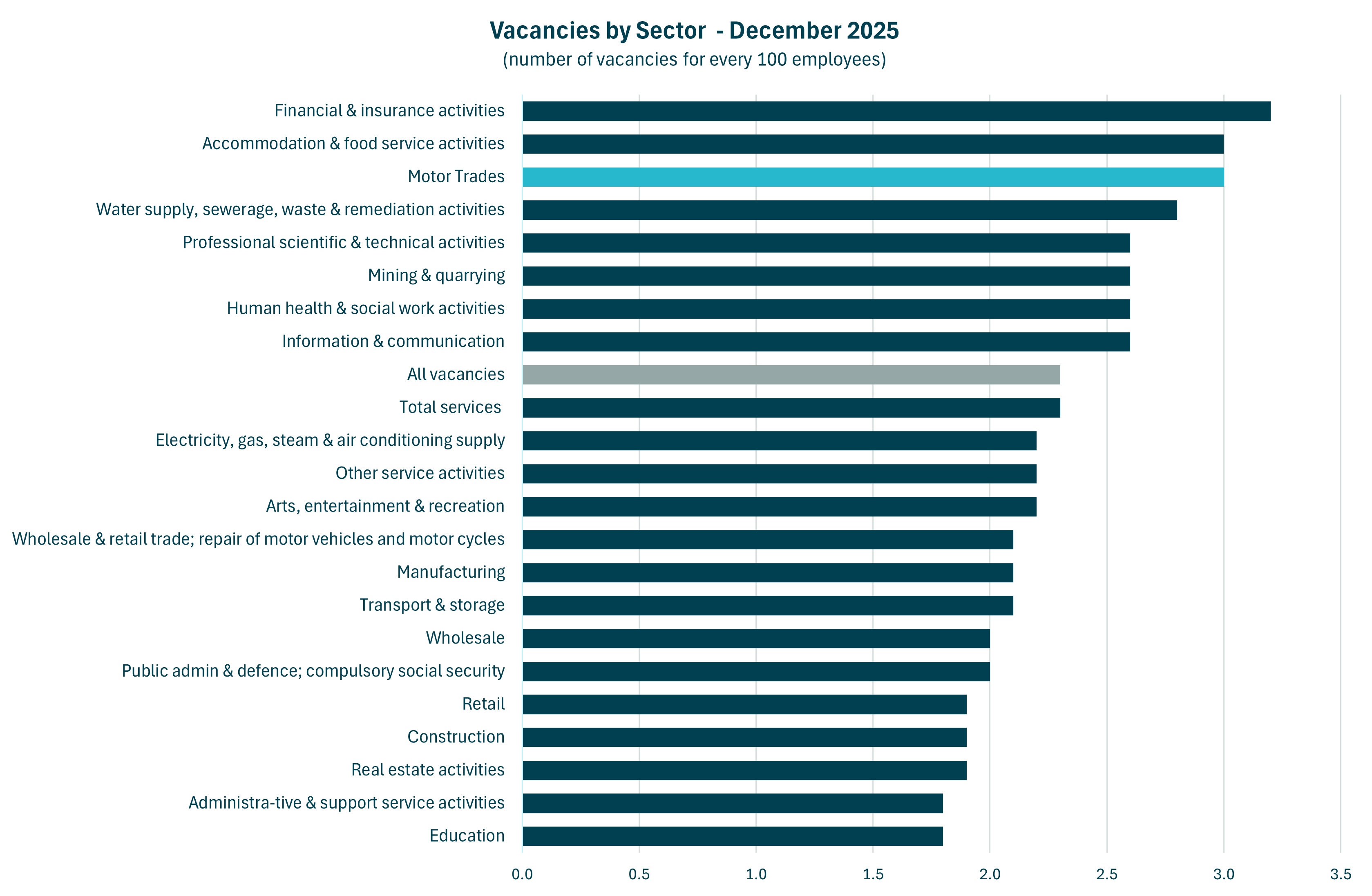

- UK industry rank: 3 out of 22

- Approximate open positions: 18,000

- Year-on-year change: 20%

- Two-year change: -30%

Vacancies peaked at around 20,000 in September 2025 before easing back to 18,000 in November and holding at that level in December. Although this sits below the mid-year high, the sector continues to rank among the UK’s most pressured industries for recruitment.

The Motor Trades now ranks third highest for vacancies, behind finance and accommodation and food services. This reflects ongoing hiring demand, even as the wider labour market softens.

Across the UK economy, vacancies are 21% lower than two years ago, compared with a 30% fall in the Motor Trades. While conditions have eased, recruitment pressure in automotive stays relatively elevated.

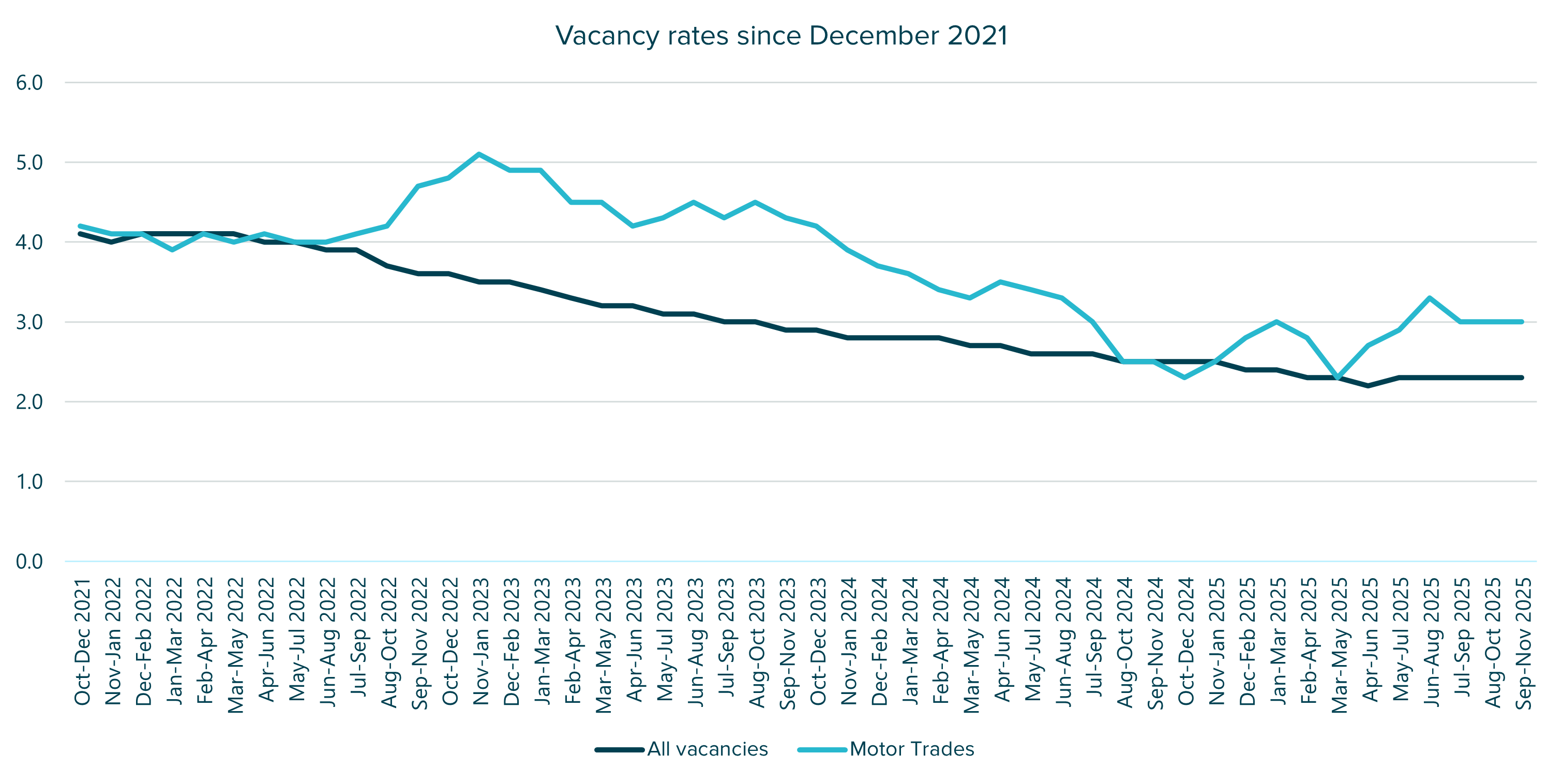

Vacancy rates over time

ONS data shows Motor Trades vacancy rates peaked in 2022, declined through much of 2024, and then stabilised during 2025.

In October to December 2025, the Motor Trades vacancy rate stood at 3.0%, compared with 2.3% across the UK economy overall. This means recruitment pressure in the sector is around a quarter higher than the national average, despite recent easing in vacancy numbers.

Key takeaways

- Vacancies ease after mid-year rise

ONS estimates around 18,000 Motor Trades vacancies in October to December 2025, unchanged from late summer, following a temporary rise earlier in the year. - Recruitment pressure stays elevated

At 3.0%, the Motor Trades vacancy rate continues to exceed the UK average of 2.3%. - Longer-term decline still evident

- Longer-term decline still evident

Vacancies are down 30% compared with two years ago, a steeper reduction than the 21% fall across all industries.

ONS vacancy estimates come from the UK Vacancy Survey rolling quarterly series. Online job advert and skills insights come from Lightcast, which analyses job postings to track hiring trends and skill demand across the UK economy.