Vacancy Tracker - January 2026

Each month, we analyse UK job vacancy data from the Office for National Statistics (ONS) to to track recruitment pressure in the Motor Trades sector.

The latest ONS figures, covering November to January 2026, estimate around 16,000 open roles across the Motor Trades. This follows a short-term rise in mid-2025 and suggests that hiring demand has levelled off rather than continuing to climb.

Automotive vacancies: January 2026 at a glance

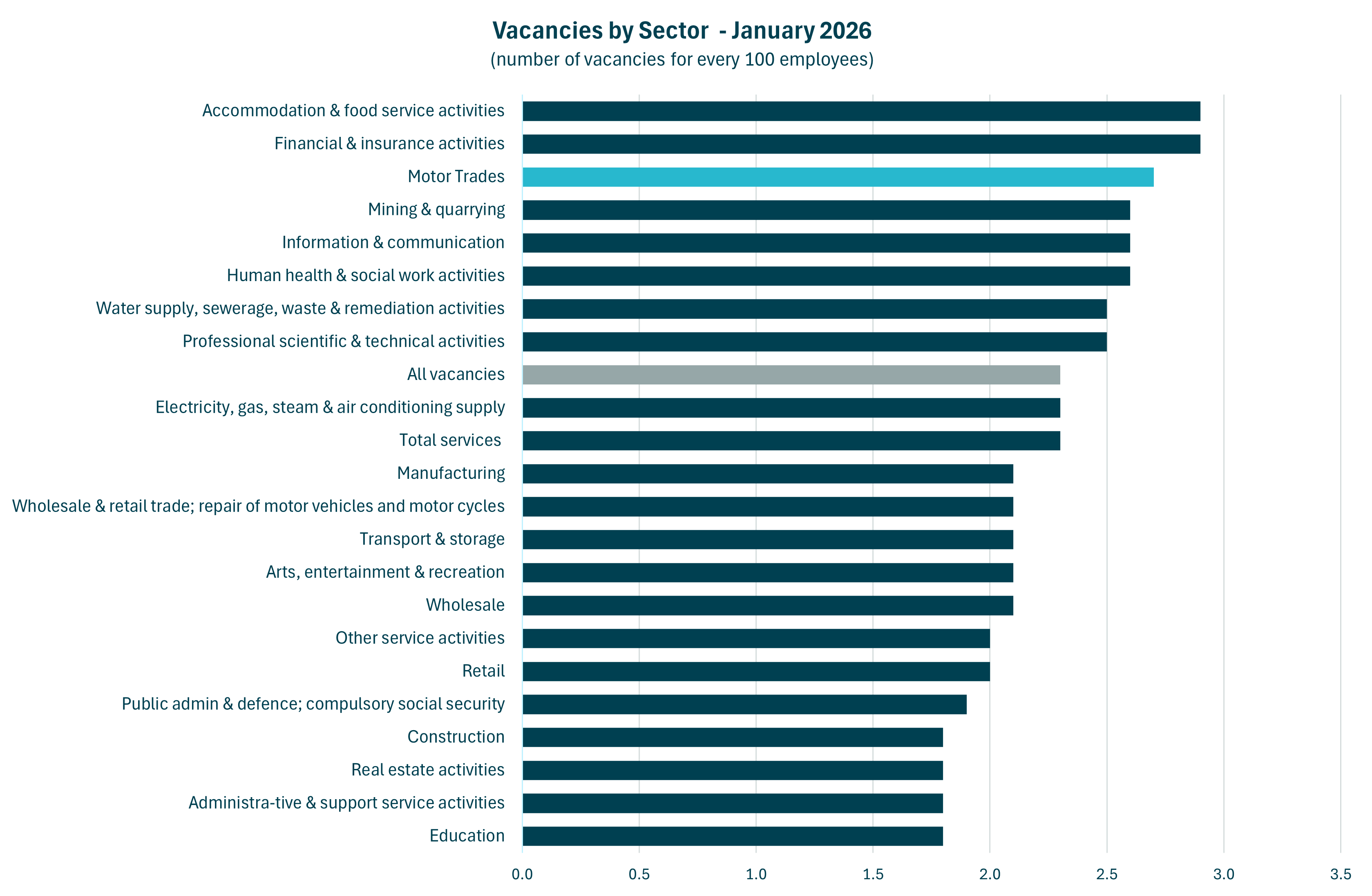

- Vacancy rate: 2.7

- UK industry rank: 3 out of 22

- Approximate open positions: 16,000

- Year-on-year change: 14%

- Two-year change: -30%

Motor Trades vacancies stood at around 18,000 through late 2025, before falling to 16,000 in November 2025 to January 2026. This confirms previous reporting that the mid-2025 rise was not sustained and that vacancy levels have continued to ease into early 2026.

While vacancy volumes are lower than earlier in the year, they are high compared with many other sectors. This points to continued recruitment pressure in the Motor Trades, even as overall hiring activity cools.

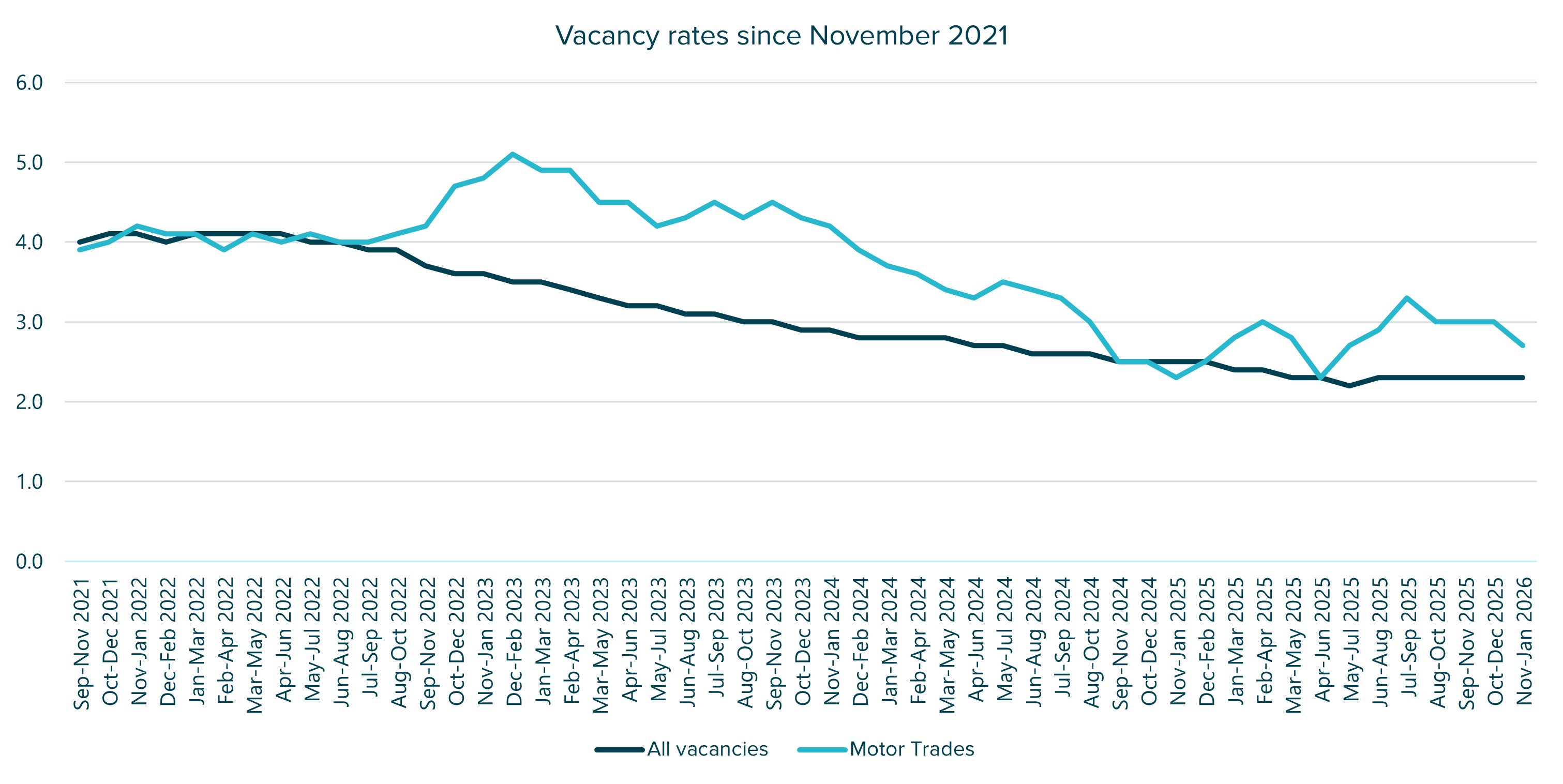

Vacancy rates over time

ONS data shows that Motor Trades vacancy rates peaked in 2022, declined through much of 2024, and stabilised during 2025, before easing slightly at the start of 2026.

In November 2025 to January 2026, the Motor Trades vacancy rate stood at 2.7, compared with 2.3 across the UK economy as a whole. This means recruitment pressure in the sector remains around 17% higher than the national average, despite the recent fall in vacancy numbers.

Wider UK vacancy picture

Across all industries, the ONS estimates around 726,000 vacancies in November 2025 to January 2026. This figure is broadly unchanged from recent quarters but is below levels seen during the earlier post-pandemic recovery period.

Over a two-year period, total UK vacancies have fallen by around 21-23%, reinforcing the picture of a cooler national labour market.

Vacancy posting behaviour: what online job adverts suggest

Alongside official ONS vacancy estimates, IMI analysis of online job adverts helps explain how employers are responding to these conditions.

Data for December 2025 shows that overall Motor Trades job posting volumes are below earlier peaks, continuing the downward trend seen since 2022. However, employers across the sector continue to advertise roles, showing that recruitment activity has not stopped.

Posting intensity is relatively stable. Employers appear to be advertising fewer roles per business, rather than withdrawing from the market altogether. This points to a more selective and cautious approach to recruitment.

Skills demand: what employers are asking for

IMI data for December 2025 shows that demand continues to focus on core mechanical and workshop-based skills, although patterns vary across occupations. The most frequently requested include:

- Vehicle maintenance

- Brakes

- Vehicle suspension

- Vehicle parts

- Invoicing

- After sales support

- Mechanics

While overall posting volumes are lower than the peaks seen in 2022 and 2023, these skills continue to feature consistently, underlining the sector’s reliance on experienced, workshop-ready staff.

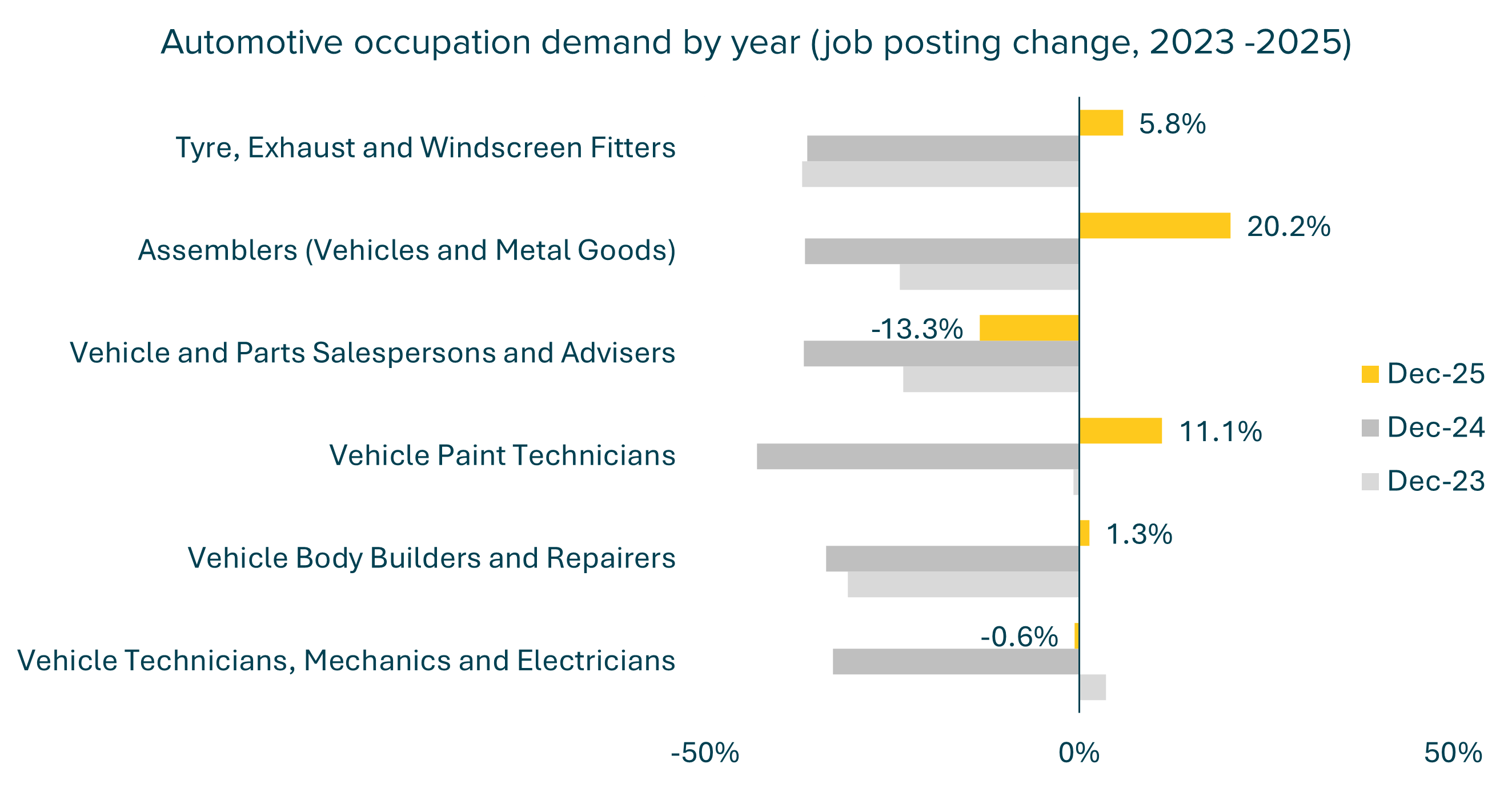

Job posting trends by occupation show a more mixed picture. As the chart above illustrates, demand increased year on year in some roles, while easing in others. In December 2025, postings rose for Tyre, Exhaust and Windscreen Fitters, Assemblers, and Vehicle Paint Technicians, suggesting continued demand in manufacturing and body repair activity. By contrast, postings for Vehicle Technicians, Mechanics and Electricians were broadly flat.

Taken together, this suggests that while overall hiring has slowed, demand has not fallen evenly across the sector. Employers continue to recruit for practical, job-ready skills, with sharper focus on specific roles rather than broad-based growth across all occupations.

Who is advertising Motor Trades roles

Employer data shows that many of the sector’s largest employers continue to advertise Motor Trades roles, but at lower volumes than a year ago.

This pattern appears across a wide range of employer types, including national service and repair chains, dealer groups, and specialist recruitment firms. Among larger advertisers, year-on-year reductions in postings often exceed 40-50% compared with 2024 levels.

Importantly, this trend appears across different parts of the sector rather than being limited to a single employer group. Both retail-facing businesses and commercial operators show similar behaviour, suggesting that reduced posting volumes reflect wider market caution rather than a drop in demand for skills.

Evolving role

Taken together, the data suggests that while employers are advertising fewer vacancies overall, the mix of skills requested is broad.

Employers continue to seek individuals who combine strong mechanical capability with diagnostic awareness, operational competence, and customer-facing skills. This supports a picture of roles becoming more demanding and multi-skilled, even as hiring activity moderates.

Key takeaways

- Vacancies continue to ease

ONS estimates around 16,000 Motor Trades vacancies in November 2025 to January 2026, down from around 18,000 in late 2025. - Sector stays above the UK average

With a vacancy rate of 2.7, the Motor Trades continues to face higher recruitment pressure than the UK economy overall (2.3). - Longer-term decline is clear

Compared with two years ago, Motor Trades vacancies are down by around 30%, broadly in line with the wider fall across the UK labour market. - Skills demand remains technical and wide-ranging

Despite lower vacancy volumes, employers continue to seek advanced diagnostic, electrical, and electrification skills alongside core mechanical expertise.

ONS vacancy estimates come from the UK Vacancy Survey rolling quarterly series. Online job advert and skills insights come from Lightcast, which analyses job postings to track hiring trends and skill demand across the UK economy.