Vacancy Tracker - November 2025

Each month, we analyse UK job vacancy data from the Office for National Statistics (ONS) to understand workforce challenges in the Motor Trades sector.

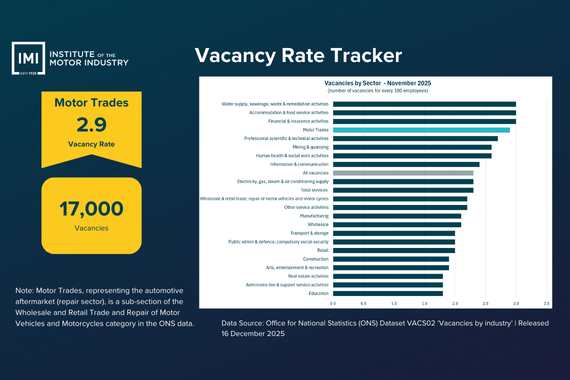

The latest ONS data, covering September to November 2025, estimates around 17,000 vacancies in the Motor Trades. This follows a short-term rise in mid-2025 and suggests that hiring demand has levelled off in recent months, rather than continuing to rise.

Automotive vacancies: November 2025 at a glance

- Vacancy rate: 2.9%

- UK industry rank: 4 out of 22

- Approximate open positions: 17,000

- Year-on-year change: -32%

- Two-year change: -25%

Automotive vacancies increased to around 20,000 in September 2025, before falling back to 17,000 in October and holding at that level in November. While this is below the mid-2025 peak, vacancy levels stay higher than in many other sectors.

This pattern suggests that recruitment demand continues, but the spike seen in mid-2025 did not carry through into the autumn. Across the UK economy, vacancies are also lower than two years ago (-25%), pointing to a softer national hiring environment alongside ongoing pressure in the sector.

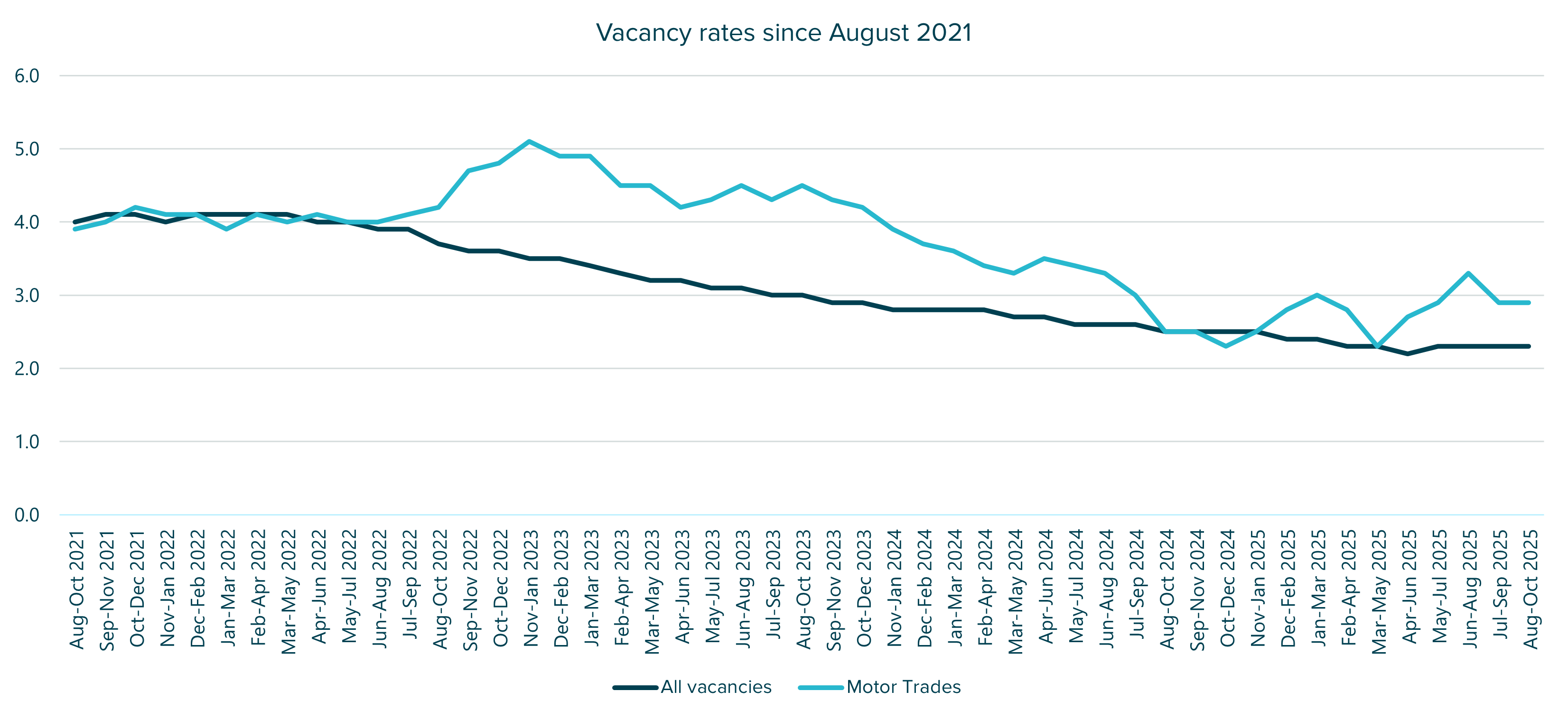

Vacancy rates over time

UK vacancy data shows that Motor Trades vacancy rates peaked in 2022, fell through much of 2024, and then stabilised during 2025.

In September to November 2025, the Motor Trades vacancy rate stood at 2.9%, compared with 2.3% across the UK economy as a whole.

This means recruitment pressure in the Motor Trades stays around a quarter higher than the national average, despite recent easing in vacancy numbers.

Vacancy posting behaviour: what online job adverts suggest

Alongside ONS vacancy estimates, IMI analysis of online job adverts adds insight into how employers are approaching recruitment.

Annual data shows that while the total number of Motor Trades job adverts has fallen from earlier peaks, many employers continue to advertise roles year on year.

However, employers now tend to advertise fewer vacancies per business. This points to a more cautious recruitment approach, rather than a complete pause in hiring.

Skills demand: what employers are asking for

The most frequently requested skills in November 2025 continue to focus on core mechanical activity, including:

- Vehicle maintenance

- Mechanics

- Vehicle inspection

- Brakes

- Suspension

- Mechanical engineering

Although volumes for many of these skills are lower than in 2022 and 2023, demand is consistently high. This reinforces the sector’s ongoing reliance on experienced technicians.

Diagnostic and electrical capability stays critical

Demand for diagnostic and electrical skills stays strong, reflecting the growing technical complexity of modern vehicles:

- Electrical diagnostics and repairs

- Electrical systems

- Electronic systems and components

- Diagnostic tools

While some electrical skill mentions sit below earlier peaks, they stay above pre-2021 levels. This points to a lasting shift towards more technically demanding roles.

Electrification and advanced systems show sustained demand

Skills linked to electrification and advanced vehicle systems continue to appear frequently in job adverts:

- Electric vehicles

- Hybrid vehicles

- Batteries

- Sensors

Although demand for EV-related skills is lower than the highs seen in 2022 and 2023, it is above levels seen in 2020 and 2021. This shows that electrification continues to shape workforce skill needs.

Broader role expectations continue to expand

IMI data also highlights wider expectations beyond hands-on repair work, including:

- Health and safety standards

- Occupational and environmental safety

- Workflow and field service management

- Technical communication and reporting

These skills reflect broader role expectations, with technicians increasingly expected to manage compliance, documentation, and service delivery alongside technical work.

Who is advertising Motor Trades roles

Many of the largest Motor Trades employers continue to post vacancies, but at much lower volumes than a year ago. This pattern appears across national service and repair chains, franchised dealer groups, vehicle manufacturers, and fleet operators.

Among larger employers, year-on-year reductions in advertised roles often exceed 50%. This suggests that organisations continue to recruit, but with greater selectivity and caution than in previous years.

Importantly, this trend appears across different parts of the sector rather than being limited to a single employer group. Retail-facing businesses and commercial vehicle operators show similar patterns, reinforcing the view that reduced hiring reflects wider market conditions rather than falling demand for skills.

Evolving role

Taken together, the skills and ONS data suggests that while employers advertise fewer vacancies overall, the range and technical depth of skills requested stays high.

This supports a picture of increasingly complex roles, with employers seeking multi-skilled individuals who can work across mechanical, electrical, and digital systems, while also meeting higher safety and compliance expectations.

Key takeaways

- Vacancies fall after mid-year rise

ONS estimates around 17,000 Motor Trades vacancies in September to November 2025, unchanged from August to October, following a temporary rise to 20,000 in July to September. - Sector stays above the UK average

With a vacancy rate of 2.9%, the Motor Trades continues to face higher recruitment pressure than the UK economy overall (2.3%). - Longer-term decline still clear

Compared with two years ago, Motor Trades vacancies are down 36%, a steeper fall than the 23% decline seen across all industries. - Skills demand stays broad and technical

Despite lower vacancy volumes, employers continue to seek advanced diagnostic, electrical, and electrification skills alongside core mechanical expertise.

ONS vacancy estimates come from the UK Vacancy Survey rolling quarterly series. Online job advert and skills insights come from Lightcast, which analyses job postings to track hiring trends and skill demand across the UK economy.